Financing options for your project

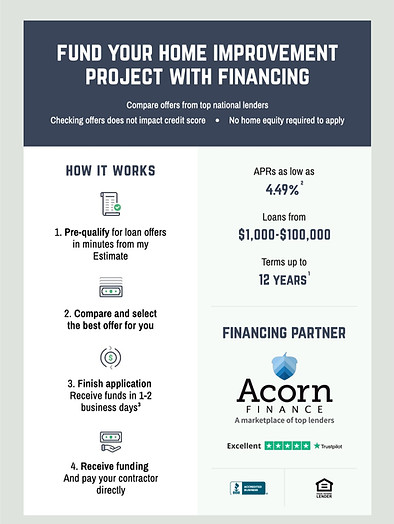

Embarking on a new project is an exciting endeavor, but can also be a crucial financial investment. At J&R Mobile Welding Services, we understand that only some have the funds to cover the entire cost upfront. That’s why we offer a range of flexible options to help make your project a sucess!

Our Financing Options

J&R offers diverse financing solutions to accommodate various financial situations. Whether you have excellent credit or a less-than-perfect credit history, we have options tailored to your unique circumstances.

-

Easy Credit Application

-

40 Different Loan Options

-

No Interest / No Payment Options

-

Low Monthly Payment Options with Flexible Terms

-

Fast approvals – Fast Funding

-

Good Credit – Bruised Credit Project Financing

Benefits and questions of Financing Your Home Remodeling Project

Spread Out Payments Over Time

Financing allows you to enjoy the immediate benefits of your renovation without bearing the entire financial burden upfront. You can allocate your funds more effectively while investing in improving your home by spreading out the payments over time. This flexible approach ensures you can continue meeting other financial obligations seamlessly.

Attractive Rates and Flexible Terms

Our financing options come with attractive interest rates and flexible repayment terms tailored to fit your budget comfortably. With a range of solutions, our team will advise and help identify the most suitable option for your unique financial situation and goals.

How much can I borrow for my home remodeling project?

The amount you can borrow depends on different factors, such as your income, credit history, and property value. Our team will work closely with you to determine the loan amount for which you qualify.

What credit score is required for financing?

While credit requirements may vary depending on the financing option, we work with lenders considering a range of credit scores. Even if your credit could be better, we can help you explore suitable financing solutions.

How long does the approval process take?

The approval process time can vary. However, many of our lenders offer fast approvals, allowing you to promptly receive the funds you need.

What documentation is required for the application process?

Typically, you must provide proof of income, employment information, and documentation related to your home and any existing mortgage or loans. Our team will guide you through the requirements for your chosen financing option.